what nanny taxes do i pay

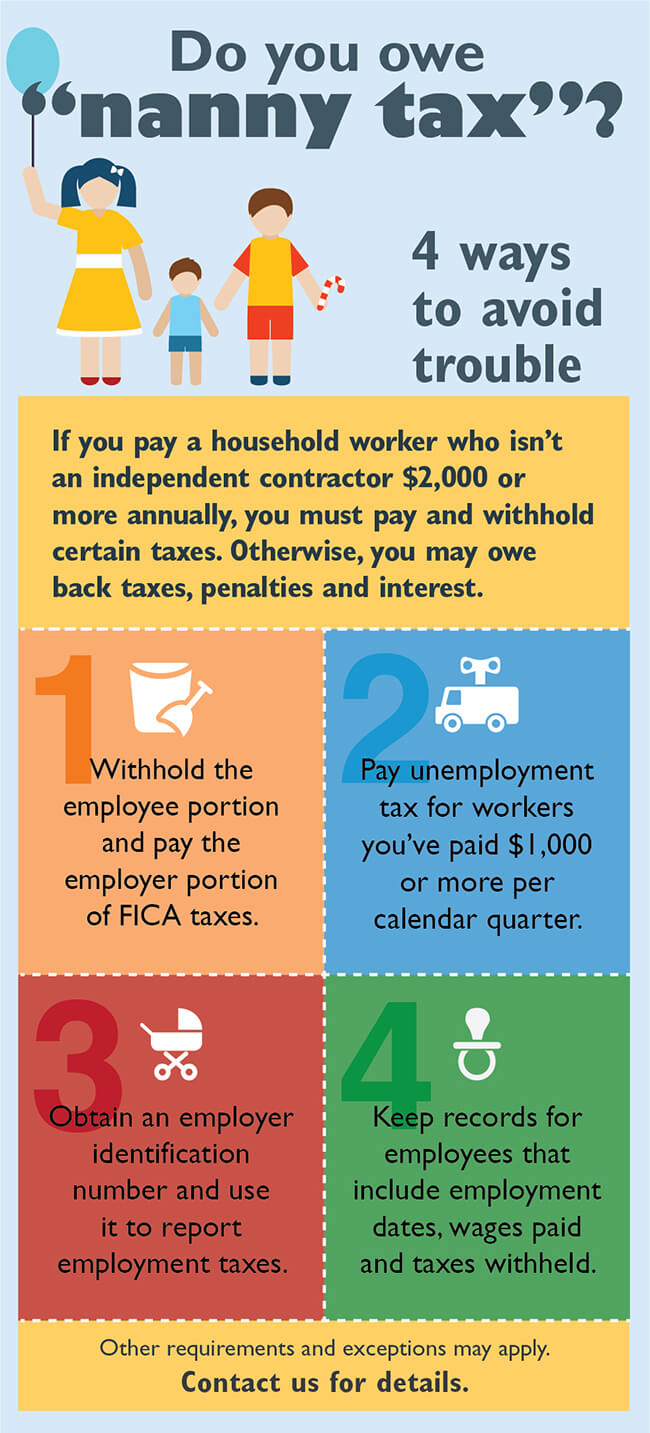

This will equal the nannys gross monthly wages before federal and state taxes are withheld. Like other employers parents must pay certain taxes.

How To Pay Nanny Taxes Yourself Care Com Homepay

Calculate social security and Medicare taxes.

. Like other employers parents must pay certain taxes. If parents pay a nanny more than 2100 wages in 2019 the nanny and the. Instead of withholding the.

Prepare year-end tax documents. You will use this form to file your. Your employer is required to give you a form W2 by January 31st.

Note that as of 2020 you can pay your nanny up to 2199 gross per year before you both may be responsible for FICA taxes. Complete the required setup paperwork. Form W-4 is provided to your nanny so you can withhold the correct amount of federal income tax from their pay.

You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met. Send taxes to the IRS and state throughout the year. Who pays the nanny tax.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765. I am a nanny how do I pay my taxes. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes.

Your total cost from an employer perspective will be 8-10 of the nannys salary for the nanny tax depending on your state and the total wages you pay. In the vast majority of states it will. If your nanny is a W-2 employee you must withhold taxes.

The 2022 nanny tax threshold is 2400 which means if a. This form will show your wages and any taxes withheld. You must stop withhold Social Security tax after your nannys wages for the year reach 117000.

Before you dive in its a good. What do you need to know about nanny payroll. You and your employee each pay 765 of gross wages 62 for Social Security and 145 for Medicare.

What are these taxes. Household employment is one of the few. This includes 62 for Social Security tax and 145 for Medicare tax.

If you have a nanny or any household employee who makes more than 2300 in a calendar year you have to pay a combination of state and federal taxes. Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year. The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount.

If your nannys salary is. You need BOTH of these conditions to be true. Calculate payroll each pay period.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765. The difference lies in the way you pay your nanny and how he or she claims the income on his or her income taxes. Simply divide your nannys total annual salary by 12.

You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met.

Nanny Household Employment Tax Who Owes It Taxact

Do You Owe Nanny Tax Yeo And Yeo

The Nanny Tax Nightmare Risks In Paying Domestic Workers Under The Table

Paying Your Nanny By Law Homework Solutions

:max_bytes(150000):strip_icc()/hire-a-nanny-58e10a823df78c516250c87c.jpg)

What To Know About Household Employee Taxes

Nanny Tax Rules How You Know If You Owe Payroll Taxes For Someone Who Works In Or Around Your Home

What Is The Nanny Tax And Am I Required To Pay It

How Do Nanny Taxes Work They Re Complicated But Skipping Them Is A Mistake Marketwatch

Nannypay Software Nannypay Twitter

Nanny Pay Taxes Saint Paul Minnesota Tent Group

Nanny Taxes Nanny In Los Angeles Riveter Consulting Group

Why Should I Pay Nanny Taxes If My Nanny Is Ok With Being Paid Off The Books Stanford Park Nannies Stanford Park Nannies

The Abcs Of Nanny Taxes Beltway Bambinos

What Is The Nanny Tax And How Do I Pay It For Household Employees

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Paying Your Nanny Legally In Texas The First Milestones

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom